Clark Wealth Partners Things To Know Before You Get This

Wiki Article

Get This Report on Clark Wealth Partners

Table of ContentsGet This Report about Clark Wealth PartnersClark Wealth Partners for BeginnersAbout Clark Wealth Partners9 Simple Techniques For Clark Wealth PartnersSome Ideas on Clark Wealth Partners You Should KnowThe Facts About Clark Wealth Partners UncoveredIndicators on Clark Wealth Partners You Should Know

These are professionals who supply investment advice and are signed up with the SEC or their state's protections regulator. Financial experts can additionally specialize, such as in trainee fundings, elderly needs, tax obligations, insurance coverage and various other aspects of your funds.Yet not constantly. Fiduciaries are legally required to act in their customer's ideal passions and to keep their cash and residential or commercial property separate from various other assets they manage. Only financial experts whose designation calls for a fiduciary dutylike licensed financial organizers, for instancecan state the exact same. This distinction additionally implies that fiduciary and financial consultant fee structures vary too.

Clark Wealth Partners Things To Know Before You Get This

If they are fee-only, they're much more most likely to be a fiduciary. Many credentials and classifications call for a fiduciary task.

Picking a fiduciary will certainly ensure you aren't steered towards particular investments as a result of the payment they supply - financial advisor st. louis. With lots of money on the line, you may want a monetary specialist that is legally bound to use those funds carefully and only in your benefits. Non-fiduciaries may advise financial investment products that are best for their wallets and not your investing objectives

The Single Strategy To Use For Clark Wealth Partners

Read extra now on just how to maintain your life and cost savings in balance. Boost in savings the ordinary home saw that worked with a financial expert for 15 years or even more contrasted to a similar family without a financial expert. Resource: Claude Montmarquette & Alexandre Prud'homme, 2020. "A lot more on the Worth of Financial Advisors," CIRANO Job Reports 2020rp-04, CIRANO.

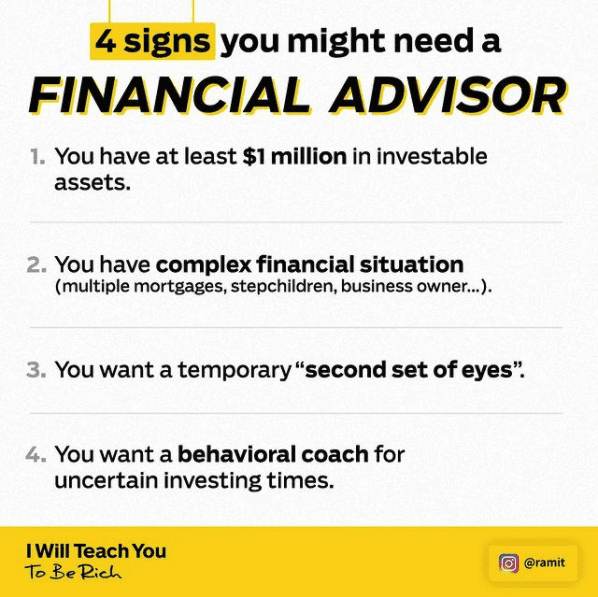

Financial guidance can be helpful at turning factors in your life. Like when you're beginning a family members, being retrenched, preparing for retired life or handling an inheritance. When you consult with an adviser for the very first time, function out what you want to obtain from the advice. Before they make any kind of referrals, an adviser must put in the time to review what is necessary to you.

The Single Strategy To Use For Clark Wealth Partners

As soon as you have actually concurred to go ahead, your financial consultant will prepare an economic plan for you. You should always feel comfy with your adviser and their advice.Urge that you are informed of all purchases, which you get all communication associated to the account. Your adviser might suggest a managed optional account (MDA) as a way of managing your financial investments. This entails signing an arrangement (MDA contract) so they can buy or market investments without needing to contact you.

A Biased View of Clark Wealth Partners

Prior to you buy an MDA, compare the benefits to the costs and threats. To safeguard your cash: Do not provide your adviser power of attorney. Never ever sign a blank document. Put a time frame on any type of authority you give to deal investments on your part. Insist all correspondence regarding your financial investments are sent out to you, not simply your consultant.This may take place during the meeting or online. When you get in or restore the continuous charge setup with your consultant, they need to define just how to finish your relationship with them. If you're relocating to a new adviser, you'll need to arrange to move your economic documents to them. If you require aid, ask your consultant to clarify the process.

will retire over the next years. To load their shoes, the country will certainly need even more than 100,000 new financial consultants to enter the sector. In their everyday work, financial consultants take care of both technical and imaginative tasks. United State News and Globe Report placed the function amongst the leading 20 Finest Business Jobs.

The Greatest Guide To Clark Wealth Partners

Aiding people achieve their financial objectives is a financial consultant's primary feature. They are additionally a little service proprietor, and a part of their time is devoted to managing their branch workplace. As the leader of their technique, Edward Jones financial advisors require the management abilities to work with and take care of staff, along with the organization acumen to create and execute a service approach.Investing is not a "set it and forget it" task.

Financial advisors should schedule time each week to fulfill brand-new people and capture up with the people in their round. Edward Jones monetary advisors are privileged the home office does the hefty lifting for them.

The smart Trick of Clark Wealth Partners That Nobody is Talking About

Continuing education and learning is a required part of keeping a financial expert license (financial planner in ofallon illinois). Edward Jones financial experts are motivated to pursue added training to broaden their understanding and skills. Dedication look at here now to education safeguarded Edward Jones the No. 17 spot on the 2024 Training APEX Honors checklist by Educating magazine. It's additionally a good concept for economic advisors to participate in industry seminars.Report this wiki page